Cardano founder Charles Hoskinson has declared Midnight officially launched, describing it as the “first fourth generation cryptocurrency” and claiming it has already become “a billion dollar ecosystem heading to a $10 billion ecosystem.”

In a December 9 livestream from Colorado, recorded after he was forced to cancel an appearance at Abu Dhabi Finance Week due to severe food poisoning and a jet malfunction, Hoskinson framed the launch as both a technical milestone and an ideological statement about how cryptocurrencies should be built and distributed.

Cardano Founder Touts Midnight’s Fair Launch

Despite saying he had “not eaten in two days” and was “a little faded,” the Cardano founder focused on the scale and duration of the effort behind Midnight. “We worked on it for six years,” he said, noting “many false starts” and several technology changes before the team converged on “a roadmap and a technology stack that we feel is going to be the tech stack of the future.” Midnight’s rollout, he stressed, is structured in four phases, with the project now “in the very first phase” of that plan.

The next stage, according to the Cardan founder, will significantly expand Midnight’s capabilities. Over the coming months, the team intends to bring up a federated mainnet and an incentivized testnet, then activate “hybrid DApps with each ecosystem.”

He said “the next nine months is going to be a lot of fun” but also “a lot of work for all of us,” pointing to features such as “true hybrid applications, true multi-resource consensus, [and] true post-quantum folding schemes” that aim to “advance the state-of-the-art of all of the zero knowledge stacks.” The overarching goal, he argued, is “creating a natural easy way for people [to] get their privacy back.”

Privacy and chain-agnostic interoperability are at the core of how Hoskinson positioned Midnight. He said users are “starting to realize and starting to wake up that their privacy is not a guarantee and it’s not a given,” and criticized existing systems as “designed from the ground up to take your privacy from you.”

Midnight, by contrast, is framed as infrastructure that can be used by “every single blockchain in the space.” “What makes Midnight so special is the fact that Midnight is for everyone,” he said. “It has equal application to Solana users and Avalanche users and Ethereum users and Binance users and Cardano users and Bitcoin users and everyone else in between.”

The Cardano repeatedly emphasized distribution and launch mechanics as a deliberate rejection of the venture-driven model that dominates much of the industry. He highlighted that Midnight was brought to market “in a completely decentralized way” with “no ICO, no insiders, no VC participation.”

The outcome, in his view, is that “every single user enjoys the fact that it had a fair launch and a fair distribution and every single person was on equal footing through the Glacier Drop, the Scavenger Hunt, and now the exchange distributions.”

On that basis, he argued that “it’s still possible in 2025 to launch a cryptocurrency the way Satoshi did it” and “still possible to build something with vision and values where we can do better and not hand the world over to centralized actors, the finance of old.”

Hoskinson Warns Of Regulatory Overreach

He also used the Midnight launch to issue a broader warning about regulation and the direction of the industry if privacy-preserving infrastructure is not defended. “Right now the laws are being written. They’re written the wrong way,” he said. “If the rulemaking is done the wrong way, every single thing that makes cryptocurrency special will be taken from us.”

Hoskinson rejected a future where “only custodial wallets” exist, “every single person has to be KYC and AML,” and “only five or 10 protocols are pre-selected” and “armchair controlled by a small cabal of international bankers.” Instead, he said, “I want to live in a world where the protocols preserve and protect your rights as a human, your agency as a human, your economic identity as a human.”

Hoskinson described Midnight as “probably the fastest growing and most vocal project we’ve ever built,” pointing to “hundreds of ambassadors” coming online and a rapidly filling Discord, which he framed as a gathering point for those who believe in “freedom of association, commerce, and expression.”

He ended with a direct call to action: “I want you to join the Discord. I want you to become an ambassador and tell each and every person that we can do better. And I want you to build on Midnight.” Whatever network developers come from, he said, “just build something and show the world that you can do interesting and cool things,” adding that for him and his team, “we’re in it for life.”

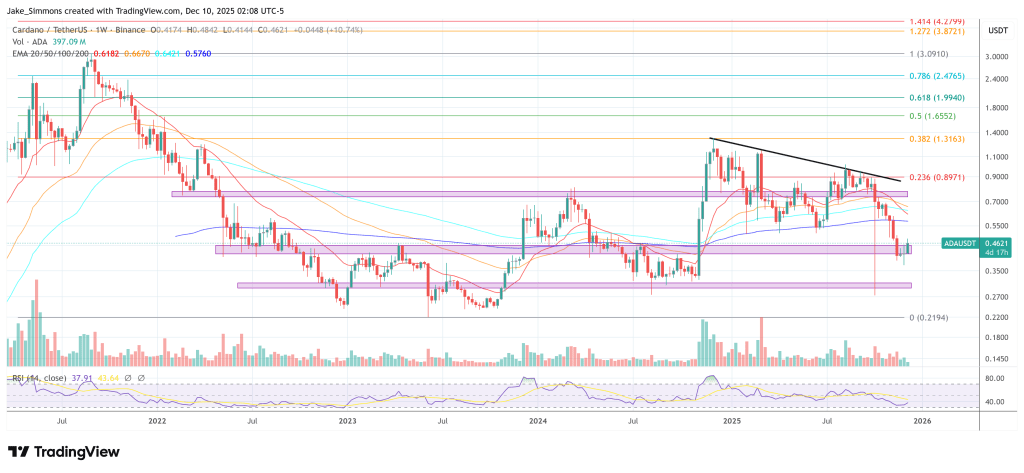

At press time, Cardano traded at $0.4621.